This cookie is set by GDPR Cookie Consent plugin. These cookies ensure basic functionalities and security features of the website, anonymously. Necessary cookies are absolutely essential for the website to function properly. Examples of accounts not affected by closing entries include asset, liability, and equity accounts. These accounts have continuous balances that carry forward from one accounting period to another. Permanent accounts are not affected by closing entries. Which accounts remain unaffected by closing entries? Once adjusting entries have been made, closing entries are used to reset temporary accounts and transfer their balances to permanent accounts. Adjusting entries ensure that revenues and expenses are appropriately recognized in the correct accounting period. No, closing entries are performed after adjusting entries in the accounting cycle. Should closing entries be performed before or after adjusting entries? These accounts include asset accounts, liability accounts, and equity accounts. Permanent accounts do not need closing entries. Which types of accounts do not require closing entries?

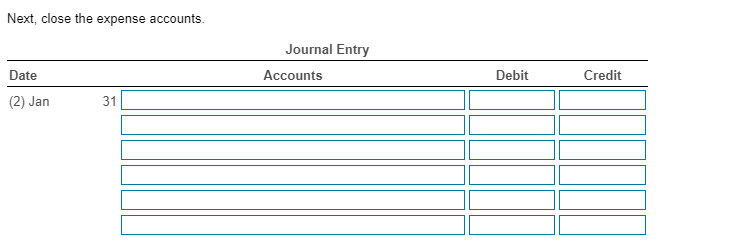

The general journal is used to record various types of accounting entries, including closing entries at the end of an accounting period. In which journal are closing entries typically recorded?Ĭlosing entries are typically recorded in the general journal. The general ledger is the central repository of all accounts and their balances, including the closing entries. Yes, closing entries are posted to the general ledger.

How are closing entries posted in the general ledger?

#Due to due from closing journal entries software#

Streamline the closing entry process by utilizing modern and dependable accounting software features that automate calculations, generate reports, and ensure accurate execution. Analyze differences and investigate unexpected fluctuations for accurate and consistent financial reporting. Scrutinize transactions between related entities or departments, eliminating or appropriately consolidating intercompany revenues and expenses for consolidated financial statements.Īccount for timing differences in revenue and expenses, ensuring all relevant transactions from the accounting period are included to prevent misstatements.Ĭompare current financial statements with prior periods to detect significant variances or anomalies. Perform closing entries steps consistently at the end of each accounting period, whether monthly, quarterly, or annually to minimize errors and maintain accurate financial records. Based on their insights, here are the five biggest practical takeaways to follow: Ensure you’re adjusting the revenue under the temporary accounts tab, not the accrued or deferred revenue found under assets and liabilities, respectively, as these are permanent accounts.Īt HighRadius, we recently surveyed seasoned accountants across industries to gather their expertise on closing entries.

#Due to due from closing journal entries trial#

0 kommentar(er)

0 kommentar(er)